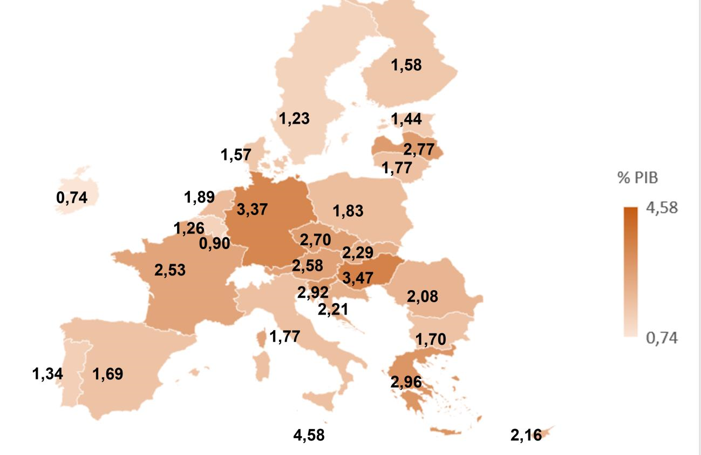

- In the analysis by EU countries, it is noteworthy that Germany achieves a level of state aid of 3.37% of GDP, or France 2.53%, highlighting the two large EU countries, with a considerable difference compared to the Spanish case (1.69%).

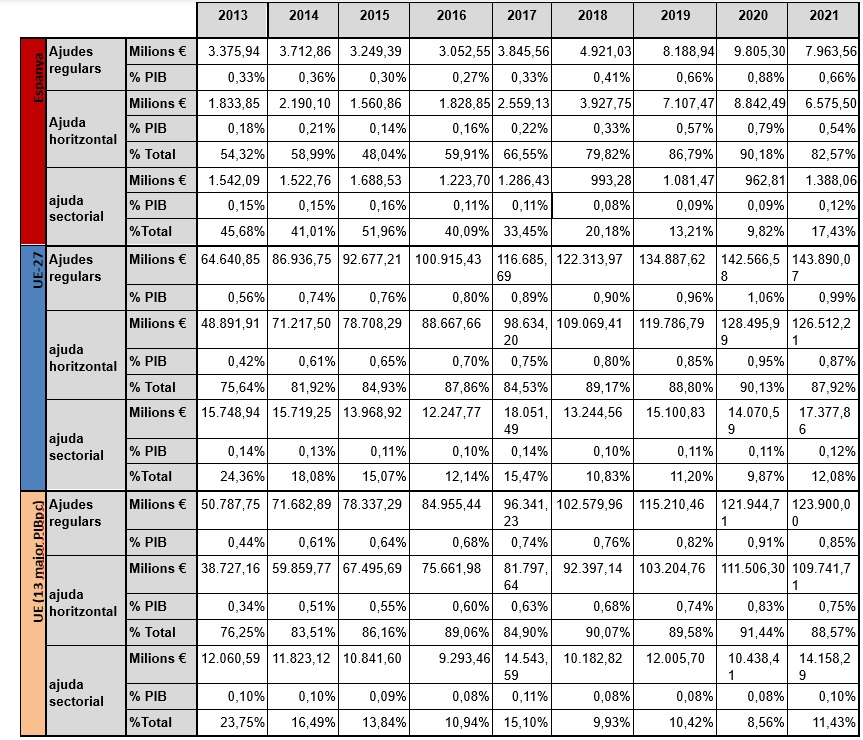

- The weight of tax deductions as a mechanism of state aid should be increased in the Spanish case, as it shows a relatively lower level, and in 2021 it was 5.61% compared to 13.82% for the EU-27.

- Although the amount allocated to environmental and energy efficiency policies for state aid in Spain has increased, it is still lagging (41%) compared to the EU-27 (55%). Therefore, this area needs to be reinforced to boost the Spanish green economy through the use of ad hoc incentives.

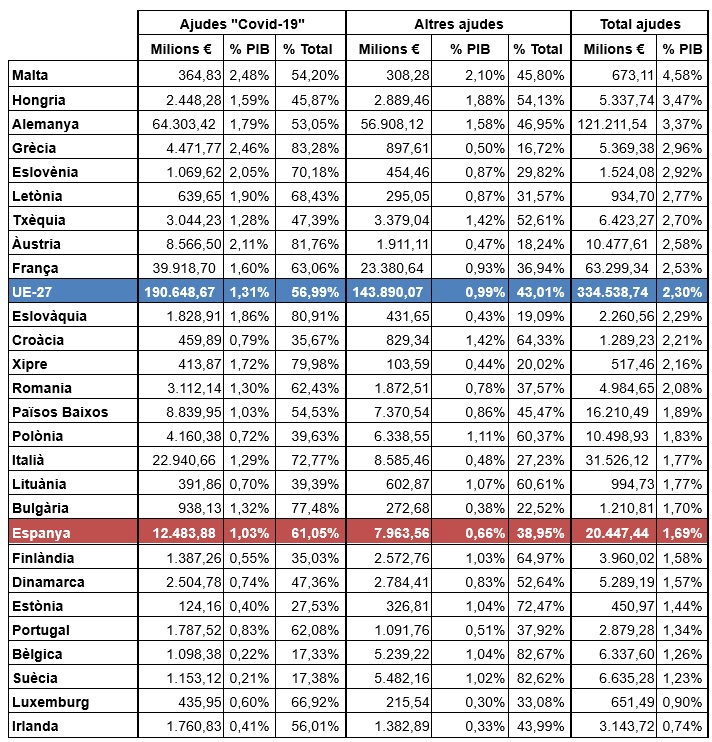

The recent report published by the National Commission on Markets and Competition (CNMC) on public aid shows that, in the Spanish case, there is still a lower relative contribution, in terms of GDP, compared to the main European countries, and especially more significantly with the industrial countries of central Europe. Thus, state aid for 2021 was at the European average (EU-27) at 2.30% of GDP, while in the Spanish case it was only 1.69% of GDP. Additionally, in the Spanish case, the relative importance of COVID aid represents 61% compared to 57% for the European set, meaning a higher concentration of more conjunctural aid associated with the health crisis. In the country analysis, it is relevant to point out that Germany provides a level of state aid of 3.37% of GDP, or France 2.53%, highlighting the two large EU countries, with a considerable difference compared to Spain. Therefore, it is necessary to insist, in the context of a single market, that it would be convenient to strengthen public aid policies by the Spanish government, as is done in other countries. These data show, in the Spanish case, this poor level of state aid, in relative terms, where Spain ranks ninth within the EU-27.

Graphic 1. Weight on national GDP of regular aid in the EU-27

Source: CNMC

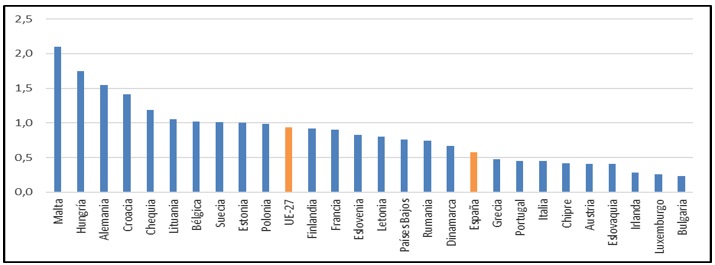

This behavior is also reflected in the data shown for the level of regular aid to industry and services on GDP, as can be seen in graphic 2, where the difference between Spain and the European average (EU-27) is significant, highlighting again the case of Germany, which is among the leading positions.

Graphic 2. Weight of regular aid to industry and services on GDP (2021) in the EU-27

Source: CNMC. Does not include the railway sector or “COVID-19” aid.

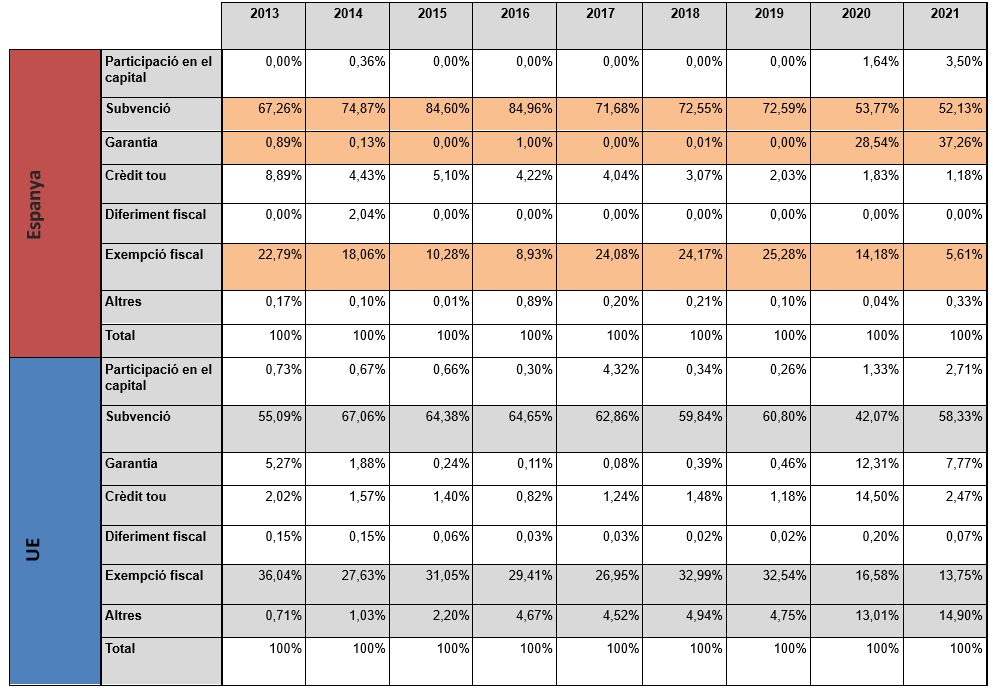

In the Spanish case, subsidies stand out as the instrument of public aid, accounting for 72.59% of total aid until 2019. Although with COVID aid, public guarantees to the ICO were reinforced, so the guarantee instrument went from representing 0% in 2019 to 37.26% of total public aid in 2021, and the relative weight of the subsidy instrument fell to 52% in 2021. Exemptions or tax deferral in 2021 represent 5.61% in the Spanish case, while the use of the tax instrument is more intense in the European case (EU-27), reaching a percentage of 13.82%. Therefore, we understand that the tax instrument is scarcely used in the Spanish case, unlike the European average, and should be promoted, as it facilitates the management of aid without being subject to deadlines like subsidies, and involves less bureaucracy and delay in its implementation.

ANNEX

Table 1. State aid for 2021 (EU-27)

Source: CNMC

Table 2. Evolution of regular aid Spain and EU-27 (2013-2021)

Source: CNMC

After the United Kingdom’s exit, EU-27 data are included from 2013, the year in which the last Member State (Croatia) joined.

Table 3. Evolution of different instruments 2013-2021 in Spain and the EU-27

Source: CNMC

Comments are closed.